Micron Technology (MU) has caught the attention of investors worldwide with a significant premarket surge following news of a potential $6.1 billion federal grant. This grant, part of the Biden Administration’s strategic plan, aims to invigorate domestic chip manufacturing. Here’s what’s fueling the excitement and what it could mean for Micron’s future.

The Federal Boost: A Game-Changer for Micron

Reports suggest that Micron is on the verge of receiving a substantial $6.1 billion grant from the U.S. Commerce Department. This financial injection is slated to support Micron’s ambitious plans to expand its domestic chip production capabilities. The award, which is still pending finalization, forms a crucial component of the CHIPS and Science Act of 2022.

A Strategic Move: Building Domestic Capacity

Micron’s roadmap involves constructing several chip manufacturing plants, primarily in New York and Idaho. The company’s CEO, Sanjay Mehrotra, has previously highlighted the importance of government incentives to counterbalance the cost discrepancies of international expansion. The infusion of federal funds underscores a concerted effort to bolster domestic chip production and reduce reliance on overseas suppliers.

- Micron’s plans include building four factories in New York and one in its home state, with the construction contingent upon receiving a combination of government incentives.

- The CHIPS Act aims to inject $114 billion into the semiconductor industry, fostering innovation and safeguarding national security interests.

Economic Implications: A Catalyst for Growth

Beyond Micron’s corporate strategy, the federal grant carries significant economic implications. It is poised to generate an estimated 50,000 jobs, signaling a substantial boost to employment in regions where the chip plants will be established. Additionally, this investment serves as a pivotal step in revitalizing the U.S. semiconductor manufacturing sector, which has seen a decline in global market share over the years.

Market Response: Micron’s Ascendancy

Micron’s stock price has responded favorably to the news, with a notable uptick in premarket trading. While the award’s finalization is pending, investors are optimistic about the company’s prospects. However, market dynamics remain fluid, with the stock experiencing periodic fluctuations.

Looking Ahead: Navigating Uncertainty

As Micron’s trajectory unfolds, investors are advised to stay vigilant amid market volatility. Key price levels, such as $97 and $130, serve as critical indicators of support and resistance. Monitoring these levels can provide insights into the stock’s future movements and potential opportunities for investors.

Micron’s journey toward leveraging federal grants to bolster domestic chip production exemplifies a broader trend reshaping the semiconductor landscape. With strategic investments and innovative initiatives, companies like Micron are not only transforming their business models but also driving economic growth on a national scale.

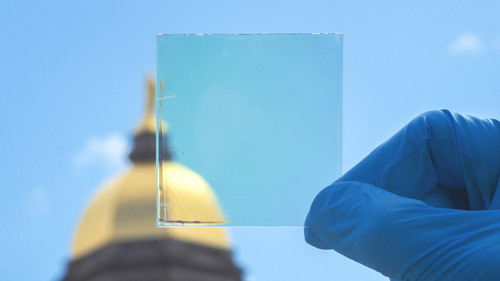

Image Source: Micron Technology, Inc

Article Source: Reuters